- Home

- |

- About Us

- |

- Working Groups

- |

- News

- |

- Rankings

- WEF-Global Competitiveness Report

- Ease of Doing Business Report

- IMD-World Competitiveness Yearbook

- TI-Corruption Perceptions Index

- HF-Economic Freedom Index

- WEF-Global Information Technology Report

- WEF-Travel and Tourism Report

- WIPO-Global Innovation Index

- WB-Logistics Performance Index

- FFP-Fragile States Index

- WEF-Global Enabling Trade Report

- WEF-Global Gender Gap Report

- Gallery

- |

- Downloads

- |

- Contact Us

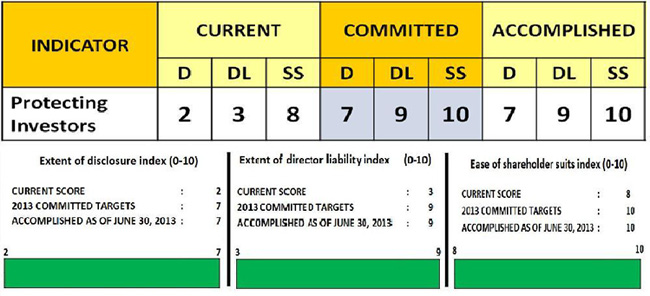

Protecting Investors

Protecting Investors measures the strength of minority shareholder protections against directors’ misuse of corporate assets for personal gain. The indicators distinguish three dimensions of investor protection: transparency of related-party transactions (extent of disclosure index, 0-10), liability for self-dealing (extent of director liability index, 0-10) and shareholders’ ability to sue officers and directors for misconduct (ease of shareholder suits index. 0-10). The case used for scoring involves a related-party transaction between two companies of which “Mr. James” is both a controlling shareholder and member of the board of directors. Higher scores indicate greater disclosure, greater liability of directors, greater powers of shareholders, and consequently, more investor protection. The work team has cited laws and actual cases to back up the raise in scores from 2, 3, and 8 to 7, 9, and 10.